This episode of FinMar Today addresses the topic of first click vs last click attribution to our marketing dollars. In this episode, I talk about the danger of trying to attribute every individual marketing activity to associated new assets. This type of thinking causes us to have fragmented marketing campaigns with a lot of starts and stops making it difficult to get your firm’s marketing off the ground.

The below content is a transcription of the above video and really meant more for Google than for you. If you prefer to read vs watch the above video, enjoy but please remember this is really meant to help the robots index my content so that you can find it when you need it.

Craig Hall here and welcome to our second episode of the FinMar Today video blog. Now this is a video blog or vlog dedicated to topics on financial marketing. Yes, I am definitely still struggling using the word vlog. It’s kind of like tweeting back when Twitter first came out.

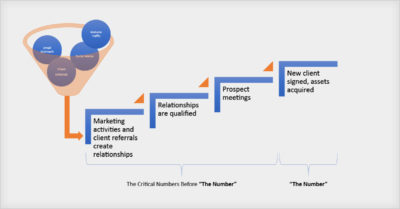

Today, I am talking about something that I’ve been talking a lot about with firms lately. The topic is related to how we attribute marketing dollars and how we measure success in our marketing. It’s what I call First Click versus Last Click Attribution. When we start to overcomplicate things by trying to associate every marketing dollar to the assets brought in based on every single activity, we run the risk of stopping prematurely. If we are running a banner ad campaign, can we measure the assets that we’re bringing in based on that one activity? If we are sending newsletters, can we measure every single revenue dollar that’s being brought into the firm based on that activity?

This applies to a host of other financial marketing communications such as print collateral and website visits. All these activities make up a prospect and client experience.

We know that 75 percent of the assets are being brought in via referral channels and it’s easy to say, “We don’t need to be doing a lot of these other things since we can’t measure them and we’re going to continue to grow organically through our referral channel.” It’s true that your firm will see most of its growth from referrals. However, it’s becoming increasingly more competitive to gain new clients in all firms and that number is going to shift.

How important is it that when a referral comes in, he or she get’s a good impression of your firm when visiting your firm’s website or reviewing a nice piece of branded print collateral that is sent in the mail after a phone call? We know they will be talking to advisors and experience all the typical things that referrals experience such as phone calls, meetings, dinners, golf, portfolio reviews, financial planning discussions and more.

In addition to the traditional advisor marketing techniques, it may help to enhance the relationship by sending a newsletter whether it’s printed or digital. Then your could start to invite your prospects to events or webinars. The blend of the traditional and non-traditional activities start to make up the experience and shape the prospect’s perception of the firm. It becomes very difficult to grow your firm’s marketing, if we fail to look at the big picture and view all the activities as on big comprehensive firm marketing strategy. We run the risk of having a lot of fragmented marketing activities with starts and stops, if after 30 days, we say “Well, we tried that and we can’t measure the ROI on that so we are going to discontinue that and try something different.”

When we do this we never really give a whole program a chance to get off the ground. I want us to think about how we can start to mature our thinking on marketing to become more holistic and inclusive of all activities that go into marketing your firm, especially as it becomes more and more competitive to grow assets.

I want to know your thoughts. Email me at chall@marketingwiz.co. Please send me a message on topics you want me to cover because I want this to be about topics that are important to you.